20+ Mortgage Calculator Kansas

The average long-term US. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan.

E 890 Road Chandler Ok 74834 13 Photos Mls 1026740 Movoto

Need help financing a new home or refinancing your current property.

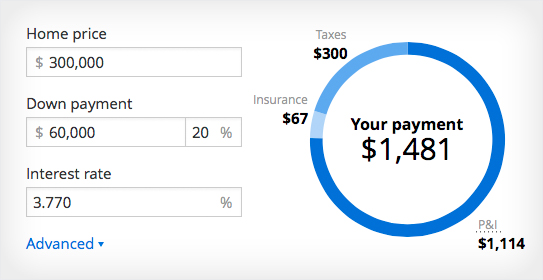

. All first mortgage products are provided by Prosperity Home Mortgage LLC. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. If your down payment is less than 20 percent youll typically get a higher interest rate and have to pay for mortgage insurance.

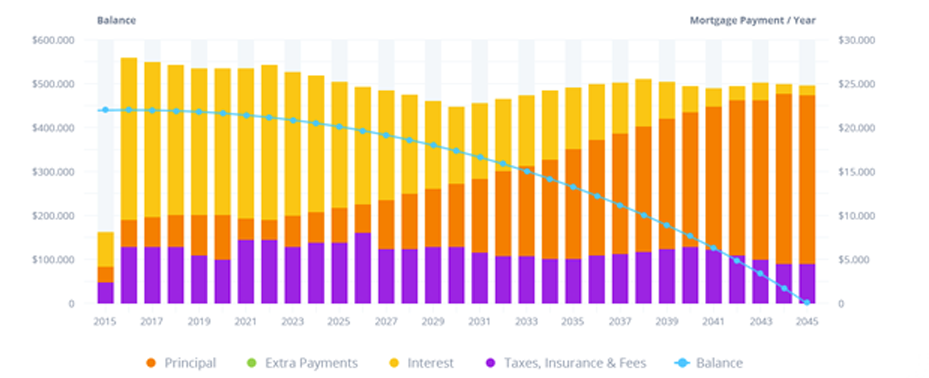

Existing Home Sales -. Long-term mortgage interest rates continued their move to record highs for 2015 according to data from mortgage finance company Freddie Mac. A mortgage in itself is not a debt it is the lenders security for a debt.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. At closing buyers are often required to open an ongoing escrow account from which their mortgage servicer will pay ongoing costs. Get the latest interest rates for 20-year fixed-rate mortgages above.

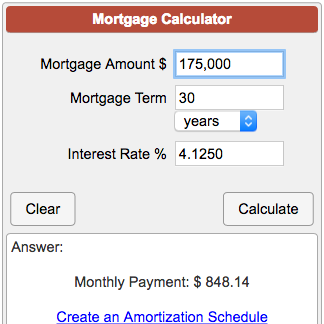

The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. For example a 30-year fixed-rate loan has a term of 30 years.

Kansas has a statewide assessment percentage of 115. Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan. The loan program you choose can affect the interest rate and total monthly payment amount.

This means that assessed value which is the value on which you pay taxes is equal to 115 of your homes appraised value. You can win mortgage preapproval in as little as 20 minutes with a letter to follow according to a Bank of America spokesperson. Escrow deposit for property taxes andor mortgage insurance.

In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate. Government loans including FHA and USDA loans charge mortgage insurance for the life of the loan but at a rate lower than conventional loans. This monthly payment protects the bank against the risk of loan non-payment.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. 51 Arm Mortgage Rates. Indeed surveys have repeatedly shown that the average American retirement savings is too.

The Loan term is the period of time during which a loan must be repaid. Todays national mortgage rate trends. July was the first month that interest rates stayed above 4 percent for the entire month since September 2014.

The Loan term is the period of time during which a loan must be repaid. We have over 74000 city photos not found anywhere else graphs of the latest real estate prices and sales trends recent home sales a home value estimator hundreds of thousands of maps satellite photos demographic data race income ancestries education employment geographic data state profiles crime data registered sex offenders. The above calculator is for fixed-rate mortgages.

If your down payment is less than 20 of the homes purchase price. We also publish current Redmond conventional loan rates beneath the calculator to help you compare local offers and find a lender that fits your needs. It is only required on a typical conforming mortgage if you pay less than 20 down until you have at least 22 equity in the home or 20 equity and you request the fee removed.

Beneath the mortgage rate table we offer an in-depth guide comparing. Conventional loans require mortgage insurance if you put down less than 20 on the home. On Tuesday September 20 2022 the current average rate for the benchmark 30-year fixed mortgage is 633 rising 23 basis points compared to this time last.

Even going from a five percent down payment to a 10 percent down payment can save you money. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan. Know Your Rights and.

The lenders average closing time is between 30 to 45 days. A mill levy is equal to 1 of taxes for every 1000 in assessed value. Get in touch with an Edina Realty Mortgage specialist.

The Consumer Financial Protection Bureau has created a special resource guide that helps explain your obligations as a reverse mortgage borrower while recovering from a natural disaster. Learn more about down payments. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

SmartAssets award-winning calculator can help you determine exactly how much you need to save to retire. An escrow account is free to open or maintain because its a requirement for loans with less than 20 down. The most common home loan term in the US is the 30-year fixed rate mortgage.

Kansas tax rates are described in terms of mill levies. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. By clicking Get Quote I consent to being contacted including by text messages at the phone number Ive provided above including marketing by using an automated dialing system or an artificial or pre-recorded voice.

You can cancel it once you pay your balance down to 80 of the homes value. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Mortgage rate fell for the fourth week in a row and have fallen more than three-quarters of a point since hitting a 20-year high last month December 08 New York Times.

Find a mortgage expert in your area. Dba Edina Realty Mortgage. For example a 30-year fixed-rate loan has a term of 30 years.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Card Advisor Credit Card Payoff Calculator Balance Transfer. 1 Most Dependent With the exception of Total Score all of the columns in the table above depict the relative rank of that state where a rank of 1.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1257 monthly payment. Download You Have a Reverse Mortgage. For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan.

Save enough for a 20 percent down payment and youll usually pay less. Kansas Property Tax Rates. Private Mortgage Insurance PMI 0 to 1.

To determine if a 20-year mortgage is right for you do the math using the Bankrate Mortgage Calculator. Especially when its 15 20 or 30 years off. Assuming you have a 20 down payment 70000 your total mortgage on a 350000 home would be 280000.

Kansas Mortgage Calculator With Taxes And Insurance Mintrates Com

Do Lenders Check Bank Statements Before Closing Find My Way Home

Mortgage Savings Strategy Interest Only Mortgage Find My Way Home

Awen Rebecca Dunning Real Estate Agent Compass

8709 E 63rd Street Kansas City Mo 64133 Zerodown

Kansas Mortgage Calculator With Taxes And Insurance Mintrates Com

7006 Radcliff Place Sugar Land Tx 77479 Compass

Oklahoma House Payment Mortgage Calculator

Oklahoma Mortgage Calculator With Pmi Taxes Insurance And Hoa

Mortgage Calculator Clear Mortgage Kansas City Mortgage Broker

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

2703 Oakland Avenue Kansas City Ks 66102 Zerodown

Get Best Mortgage Rates Today Homerate Mortgage

Top 6 Best Mortgage Comparison Calculators Ranking Top Calculators To Compare 10 15 20 And 30 Year Mortgages Advisoryhq

Mortgage Calculator Free House Payment Estimate Zillow

Mortgage Calculator

Property Search Kansas City Homes For Sale